Missing a stimulus check? IRS Letter 6475 can help you claim Recovery Rebate Credit on taxes.

Missing a stimulus check? IRS Letter 6475 can help you claim Recovery Rebate Credit on taxes.

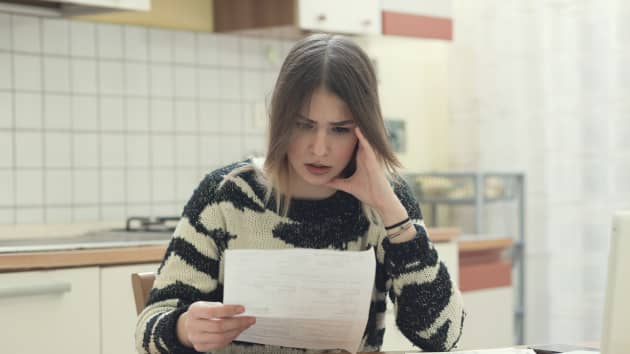

Have you received recent mail from the IRS?

If not, be on the lookout for Letter 6475, which the Internal Revenue Service began issuing in late January, that offers details about your 2021 Economic Impact Payment.

The IRS letter can help tax filers determine whether they are owed more money and if they are eligible to claim the Recovery Rebate Credit on their 2021 tax return when they file a return this year. Even if you are not owed additional money, you'll still need the letter to report any stimulus payments on your taxes.

If you received the advance child tax credit payments as many families did, you'll also need another letter before filing your taxes: IRS Letter 6419. However, be warned, some letters have inaccurate amounts, so you will want to confirm your letter is correct.

The IRS said tax filers also can check the amount of their payments in their Online Account, which has to be set up on IRS.gov in addition to the letters for both stimulus payments and child tax credits.

https://www.usatoday.com/story/money/personalfinance/2022/02/01/irs-tax-return-recovery-rebate-credit/9298020002/

https://www.AngularFinancial.com 602-456-0427

#incometaxpreparation #TaxRefund #Incometaxrefund #Angularfinancial